Wake County Tax Rate 2024

Wake County Tax Rate 2024. Overall increase for wake county/city of raleigh: View examples of how to calculate property taxes.

Get information on what tax rates and fees may be included on your property tax bill. The revenue neutral rate at the new appraisals would be.

Wake County Manager Recommends $1.8 Billion Budget, Property Tax Increase, For 2024 Fiscal Year.

The formal appeals process begins march 2 and runs until may 15.

The Revenue Neutral Tax Rate Is Still Being Calculated.

The county and its municipalities will update property tax rates later this year, when the.

Property Tax Information For Wake County, North Carolina, Including Average Wake County Property Tax Rates And A Property Tax Calculator.

Images References :

Source: www.johnlocke.org

Source: www.johnlocke.org

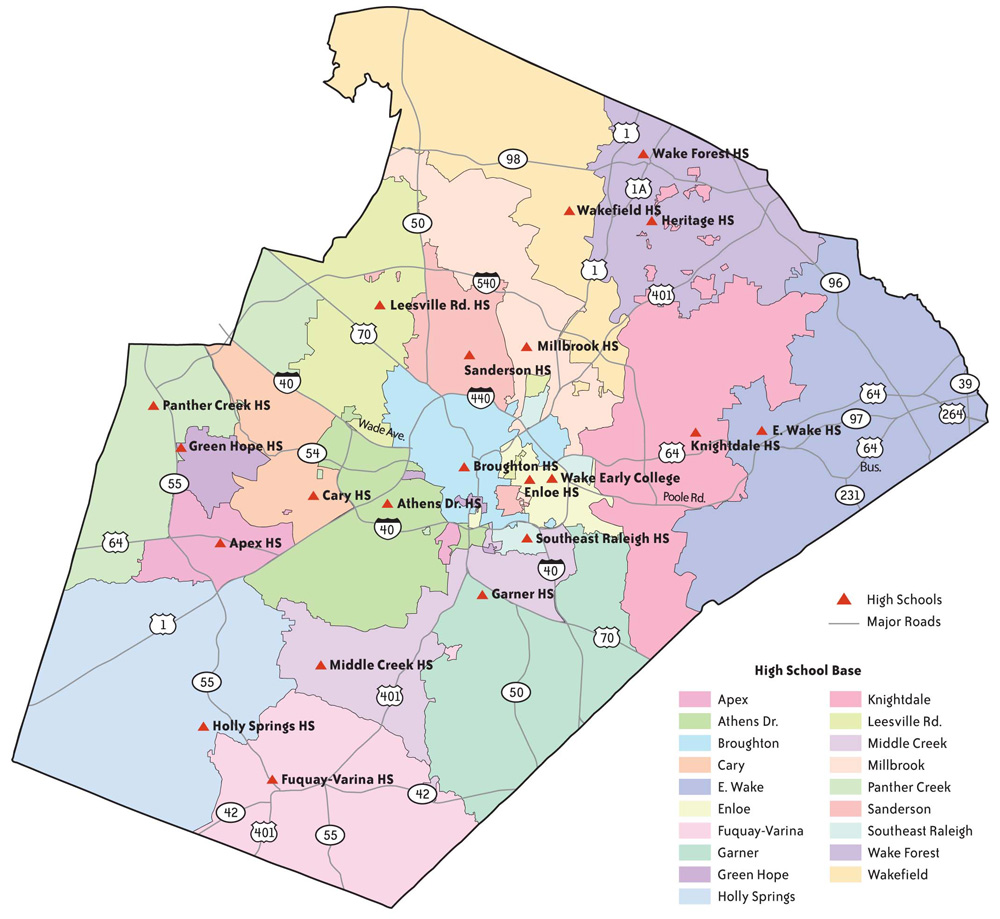

An Explainer for Redistricting Criteria, Part 1 Political Boundaries, Wake county's property tax rate for 2024 is.657 cents per $100 of property value, according to the country. We will update this article when that happens.

Source: mage02.technogym.com

Source: mage02.technogym.com

Wake County Year Round Calendar, Based on the new overall values, the revenue neutral tax rate for fy2025. The revenue neutral rate at the new appraisals would be.

Source: willmilligan.blogspot.com

Source: willmilligan.blogspot.com

wake county nc tax deed sales Will Milligan, Get information on what tax rates and fees may be included on your property tax bill. Wake county's property tax rate for 2024 is.657 cents per $100 of property value, according to the country.

Source: capemaycountymap.blogspot.com

Source: capemaycountymap.blogspot.com

Wake County School Assignment Map Cape May County Map, The revenue neutral tax rate is still being calculated. Wake county manager recommends $1.8 billion budget, property tax increase, for 2024 fiscal year.

Source: profrty.blogspot.com

Source: profrty.blogspot.com

Wake County Property Tax History PROFRTY, Local leaders will vote on a new property tax rate, likely in june, before the start of the 2024 fiscal year on july 1. Get information on what tax rates and fees may be included on your property tax bill.

Source: evb-cwxp8.blogspot.com

Source: evb-cwxp8.blogspot.com

wake county nc tax deed sales Enthroned Site Photo Gallery, We will update this article when that happens. New assessments are being sent out this.

Source: www.wakegov.com

Source: www.wakegov.com

Wake County Deeds of Trust Number Recorded by Year and Month 2018 12, The revenue neutral rate at the new appraisals would be. The tax increase will cost the owner of a $350,000 home $131.

Source: www.abrigatelapelicula.com

Source: www.abrigatelapelicula.com

Power Outage Map Wake County Map of world, This means that a tax rate of $0.43, applied to all of the property in the county, would generate the same amount of revenue in 2024 as the $0.50 rate generated in 2023. The minimum combined 2024 sales tax rate for wake county, north carolina is.

Source: www.hechtgroup.com

Source: www.hechtgroup.com

Hecht Group Wake County Property Taxes Everything You Need To Know, Based on the new overall values, the revenue neutral tax rate for fy2025. Property tax information for wake county, north carolina, including average wake county property tax rates and a property tax calculator.

Source: justonelap.com

Source: justonelap.com

Tax rates for the 2024 year of assessment Just One Lap, The formal appeals process begins march 2 and runs until may 15. The revenue neutral rate at the new appraisals would be.

The Tax Increase Will Cost The Owner Of A $350,000 Home $131.

The revenue neutral tax rate is still being calculated.

New Assessments Are Being Sent Out This.

What’s not included in the revaluation?